BitMEX lays out ambitions to expand business into spot, custody, and education services

Once the poster child for the Wild West of bitcoin derivatives trading, BitMEX announced Wednesday night its intensions to gate-crash a wide range of new businesses under a regulatory compliant mission.

In a blog post shared with The Block, the Seychelles-registered futures trading venue said it would expand beyond its bread and butter derivatives business by adding spot, brokerage, custody and information services to its product offering. The announcement comes after the exchange rolled out a user verification program to KYC all of the users on its platform.

The exchange underwent a leadership change last year after several of its executives—including its previous CEO Arthur Hayes—were charged with violating the Bank Secrecy Act.

Under the leadership of CEO Alexander Höptner, a veteran of the European stock exchange world, the firm fast-tracked user verification and is now moving into these new businesses. In an interview with The Block, Höptner declined to give a specific timeline for each new offering but said the overarching goal is to be "the largest, regulated crypto derivatives exchange." A blog post said those new businesses could arrive over "the coming months and years." Höptner said the firm will also expand its derivatives business and will launch new products, including options.

In a sense, the company is following the lead of US-based crypto exchanges. Coinbase, for instance, offers products across custody, brokerage, and spot. Gemini, another US exchange, offers settlement, custody, and retail brokerage services.

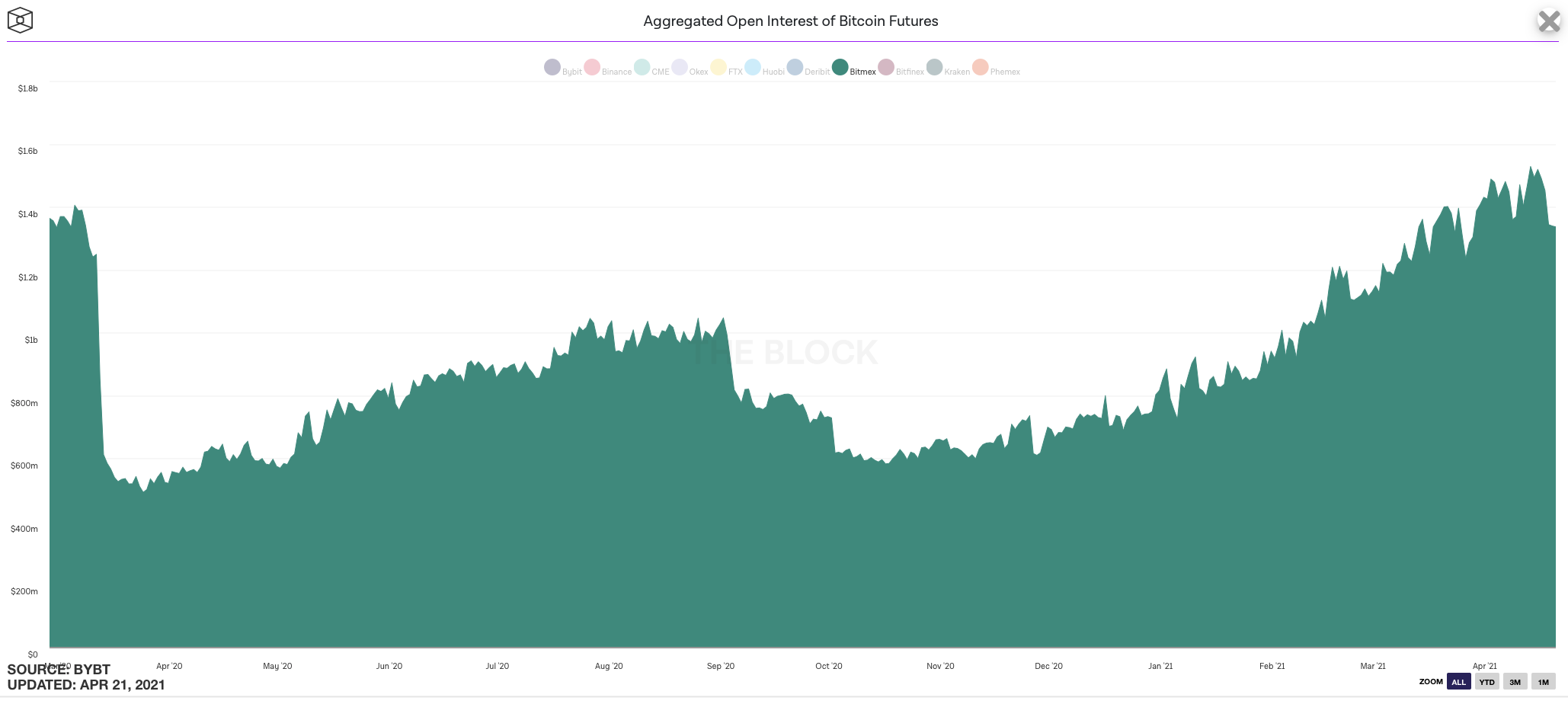

As for BitMEX, the firm's plan could help breathe new life into its once dominant business. Since the last bull market, BitMEX's market share has dwindled despite being the pioneer of the popular perpetual swap and high product leverage. Still, the firm's volumes have steadily grown over the past two quarters, as shown by The Block's data.

Höptner said the firm can continue to grow its business by serving as a center of information for regulators and clients alike through a new academy service. The project—which doesn't have a set launch date—will provide educational content on crypto trading and derivatives.

"We need to bring more transparency to regulators," Höptner said. "The way crypto exchanges work with their margin systems is different from the traditional world. The risk is not comparable. Ultimately it is up to us, and this is why we want to have an academy, to explain it."

Still, it is not clear which agency will be the firm's primary regulator.

"At this point, I can not share more on that," Höptner said.

Höptner does expect the firm to expand its headcount over the next year and said he's not ruling out a wide-range of capital raising measures.

"We are very interested in monitoring the IPO side, SPAC side, and tokenization," he said. "You have to evaluate everything."

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Post a Comment

Post a Comment