Examining Structural Changes To The Bitcoin Derivatives Market

Taking a look at some of the structural changes in the bitcoin derivatives market over the course of 2021 and what they mean.

The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Yesterday's Daily Dive took a look at some of the structural changes in the bitcoin derivatives market over the course of 2021 and what they mean.

First, what is a derivative?

A derivative is a contract between two (or possibly more) parties whose value is derived from one or more underlying assets. A contract speculating on the price of bitcoin six months from now is an example of a derivative contract.

Why does this matter, and how does it shape underlying supply and demand dynamics in the bitcoin market?

Derivatives and leverage can most certainly whipsaw price, yet what matters for the bitcoin market is the spot market (i.e., real dollar or other fiat demand to buy BTC). Derivatives and futures contracts are just directional bets on what the spot price will be.

However, derivatives markets offer the ability to use leverage to increase position size. An entity can take one bitcoin worth of capital and place trades with 10 bitcoin worth of buying power, however a 10% move in either direction can double your money, or wipe your account entirely.

During the late months of 2020 and early months of 2021, it became increasingly popular amongst traders to use bitcoin as collateral to margin long bitcoin. This strategy was extremely profitable up until April as bitcoin doubled in value in just a four month period.

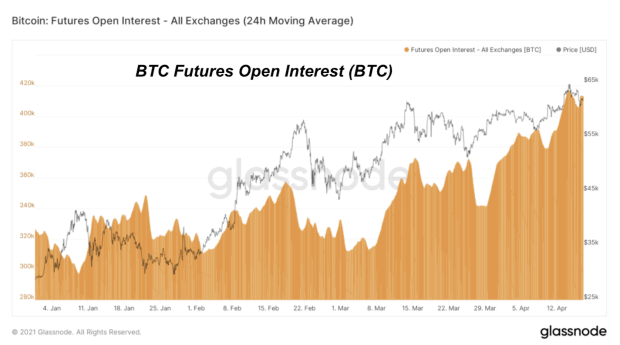

This can be seen in the chart above, showing bitcoin futures open interest climbing in bitcoin terms from January to April. The strategy of using bitcoin as collateral to leverage long bitcoin can work as long as there is fresh capital entering the market to buy the underlying asset in spot markets.

However, in April the spot bid began to slow up, and the market was left with a bunch of overextended bulls that were using their bitcoin as leverage. The problem with using bitcoin to margin long bitcoin is that during a market downturn, your position is losing value at the same time your collateral value is decreasing. There is a negative convexity to this strategy.

So why does this matter?

Because following the local top of $64,000 in April, the structure in the derivatives market has changed significantly.

Post a Comment

Post a Comment